Margrit Kennedy’s Interest and Inflation Free Money

So here comes another personal summary of a book I read. And again, it neither claims to be comprehensive nor one hundred per cent accurate. The book is Margrit Kennedy’s Interest & Inflation Free Money. I read the newest revision in German from 2006 which I think hasn’t been translated to English yet. The text is available online in several editions though.

1. Five Basic Misconceptions About Money

and the truth:

- Three kinds of growth: A: natural (logarithmic, flattening out), B: linear and C: exponential. Our current economy grows exponentially, that is the GDP and on pair the money supply increase exponentially. Because of interest, and more importantly interest on interest, a loan of 10’000$ at an interest rate of 6% increases within 50 years exponentially to 184’000$. If the money supply wouldn’t keep growing, not all the loans plus interest could be payed back, the extra money needs to come from somewhere. So indeed, our current economy must grow exponentially to sustain itself.

- We don’t only pay interest when we take up a loan. Because in every product we buy, 30-50% of the price goes actually into paying back the loans the producer took up for production. If he didn’t have to take out a loan, his products would be that much cheaper.

- Through the system of loans and debt, quite obviously there is a reallocation of money happening. The rich lending out money get even richer as the poor repay their dept plus interest.

- Inflation, the fact that our money is loosing value all the time, doesn’t need to be taken for granted. If there were no need to keep the money supply growing, there would be no risk of overgrowing it and thus no inflation.

- The current monetary system is prone to volatilities and repeating crisis, fixed towards growth no matter what, in favour of the already rich and because every sustainable long-term investment needs to measure itself against short-term gainings and interest favours short-term thinking.

Creating Interest and Inflation Free Money

Already towards the end of the 19. century the German/Argentinian economist Silvio Gesell observed economic cycles, fluctuations in prices although there were no fluctuations in actual demand. One explanation is that when interest rates are low, people with money withhold it (no incentive to lend) and thus less will be bought (because people cannot take up loans) and therefore less produced, leading the economy into a down turn. Because money becomes scarce then, interest rates go up again, the people with money are more willing to lend it, spending goes up and everything goes smooth again, until there is too much money (little demand for more) and interest rates start dropping again.

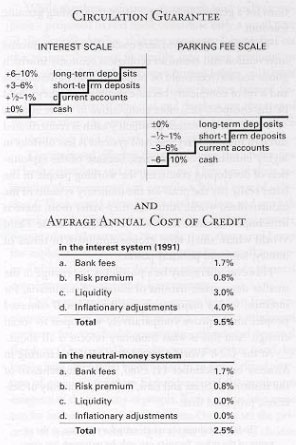

Gesell realized that money, as opposed to all other goods, can be withheld at no cost (no storage costs) and proposed to fight these economic cycles by introducing such an inventory cost. Instead of giving a reward to those lending money (through interest), those hoarding it should be punished by a small fee (one to five percent) on money. With this parking or holding fee (also called Demurrage) people are encouraged to spend their cash quickly or invest it in long-term deposits where the fee would be lower or zero. Instead of demanding interest they would be glad to invest it. Demurrage makes sure that the money remains in circulation and that its core function as a medium of exchange is conserved.

In 1932, during the Great Depression, the Austrian town of Wörgl gave this neutral money (or Freigeld) a try. For banknotes to remain valid, people had to pay to get a stamp applied to the money at the end of each month (this could obviously be done electronically today). Therefore everybody spent their money as quickly as possible, unemployment dropped by 25% within a year, and with the fee that the town government collected more projects were financed. Although a full success, the experiment was terminated only one year later by the Austrian National Bank because it saw its monopoly on printing money in danger. Similar experiments in other countries were (and often still are) prohibited on the same grounds.

The less money can be made from lending money the more attractive it obviously becomes to buy land and lend that. Thus the price of land increases. Therefore we do not only need a money reform but also a land reform. All land is seen to belong to everybody, the community then grants usage rights to those who are willing to pay most and this money is then distributed equally to every member of the community/citizen. This way, if somebody uses just as much land as the average, he doesn’t have to pay anything because what he pays for usage rights is equal to what he gets back from the community. If someone needs more land, he simply needs to pay more. But land wouldn’t be hoarded as property and couldn’t be used for speculation any more.

Furthermore, a tax reform could help save the environment: Stop taxes on income and put taxes only on products, based on how much harm they do to the environment (in production and usage). This way, human labour gets cheaper while new production of goods gets more expensive. It suddenly pays off to repair products instead of buying new ones, fewer employees get replaced by machines, illegal unreported employment disappears because nobody has to pay income tax anyway.

3. Who Would Profit from a New Monetary System?

Such a monetary reform would abolish inflation and the flow of money as interest from the poor to the rich, reduce unemployment, lower prices, get rid of the infinite growth imperative and boost long-term investments.

- Politicians and Banks: are struggling to keep the current system running, infinite growth cannot be sustained forever. National debt has been rising for several years, a lot in industrialized but even more in developing nations.

- The Rich: would be able to keep their current savings and have already enough, so most would choose a stable system over the current one.

- The Poor: In 2001, half of the German population owned only 5% of all monetary assets, the other half 95%. While the already poor pay interest to the rich (people in a country as well as from developing to industrialized countries), the welfare state and development aid try to get some of that money back to the poor in a very inefficient way.

- Churches and Spiritual Groups: Moses, Aristoteles, Jesus, Mohammed, Luther, Zwingli and Gandhi all condemned the payment of interest. Communities must have instinctively known some of the problems interest would introduce (like social inequality).

- Trade and Industry: The free market economy would continue to run as now, simply without the distortion of interest. Small and medium enterprises wouldn’t have to pay more interest than global giants.

- Agriculture: more sustainable and ecological farming

- Artists: works of art would be a save storage of value (as opposed to money with a holding fee), so the demand for art would rise.

- Women and children: equal chances.

- The Ecology of Our Planet: When the economy isn’t growing, the discrepancies between poor and rich, loaning and lending, become even more apparent. But through the infinite growth imperative, we are depleting our natural ressources. And as long as every financial investment has to measure up against the profit from interest, many long-term ecological investments won’t cut a deal. If you had 10’000$ and had to choose between taking the money to the bank and getting 5% interest, or buying solar panels and earn only, say, 3% of your investment by selling that energy, what would you choose?. With neutral money there is no interest and the pressure to generate a high return on an investment would go away, too. When loaning money, you only have to pay back the amount you loaned instead of paying the interest on the interest on the debt which increases exponentionally the longer you wait.

6. Three Models of the Future

- Infinite growth: To keep the economy growing, the state has to loan ever more money into existance and fall in debt ever more. Infinite growth cannot be sustained forever. The model will reach its limits either when natural ressources get too scarce or when the trust in the state gurarantee on its money fails.

- No growth at all: While many people talk about stopping growth while ignoring the current monetary system as the root cause (this is only fighting symptoms), others see monetary reform as the cure to solve all problems (which isn’t true neither, we need to change our lifestyle, too).

- Qualified growth: What we really want is a limited, flattening out growth in the material, physical domain while having an exponential growth in the immaterial, informational, social, ethical and cultural domain.

7. Practical Cases Today: Embryos of a New Economy

Three examples:

- LET-System: Local Exchange Trading Systems are initiatives, all over the world, to foster the local economy. There is no physical money, instead the system is based on central bookkeeping. Each participant has an account and when he pays another participant, the amount is simply subtracted from his account and added to the other’s. This concept can also be thought of interest-free loans and connects supplies and demands that the ordinary market doesn’t serve.

- WIR: Founded in 1934, WIR is a complementary currency in Switzerland supporting small and medium-sized businesses.

- JAK: is a Swedish member-owned bank that in order to give interest-free loans, demands interest free savings from its members. So while you pay back your loan, at the same time you also save. These savings can then be used to give interest-free loans to other members.

What most of these initiatives have in common is a central bookkeeping account (electronically or with pen and paper), an alternative currency (points, local Dollars, etc.), the account is allowed to go into debt up to a limited amount (people with positive balances then act as debitors), no or low interest and legal tender can usually be exchanged for the alternative currency but not the other way around. These systems currently constitue the best experiments we have on what kind of monetary systems work in what size.

8. Complementary Currencies

The goal of complementary currencies is to fill the nieches that the current system doesn’t serve and are usually tailored towards a specific need. Examples include small businesses, care of the elderly, education or to serve economically underdeveloped regions. They are meant to solve specific problems without pressuring the national budget and often create or strengthen communities at the same time.

9. What Can I Do to Help in the Transition Period?

- Inform yourself and spread the knowledge

- Invest your money in ethical projects or give interest-free loans.

- Stimulate modell experiments like complementary currencies or LETS

- Political lobbying to introduce neutral money on a larger scale